Understanding Promissory Notes in Alberta: Drafting, Enforcement, and Common Pitfalls

Promissory notes are commonly used in Alberta for business loans, shareholder advances, private financing, and deferred purchase arrangements. While they may appear simple, poorly drafted promissory notes often lead to disputes, unenforceable terms, or unexpected legal exposure.

This article explains what a promissory note is, how promissory notes work under Alberta law, common drafting mistakes, and when legal advice is essential to protect your interests.

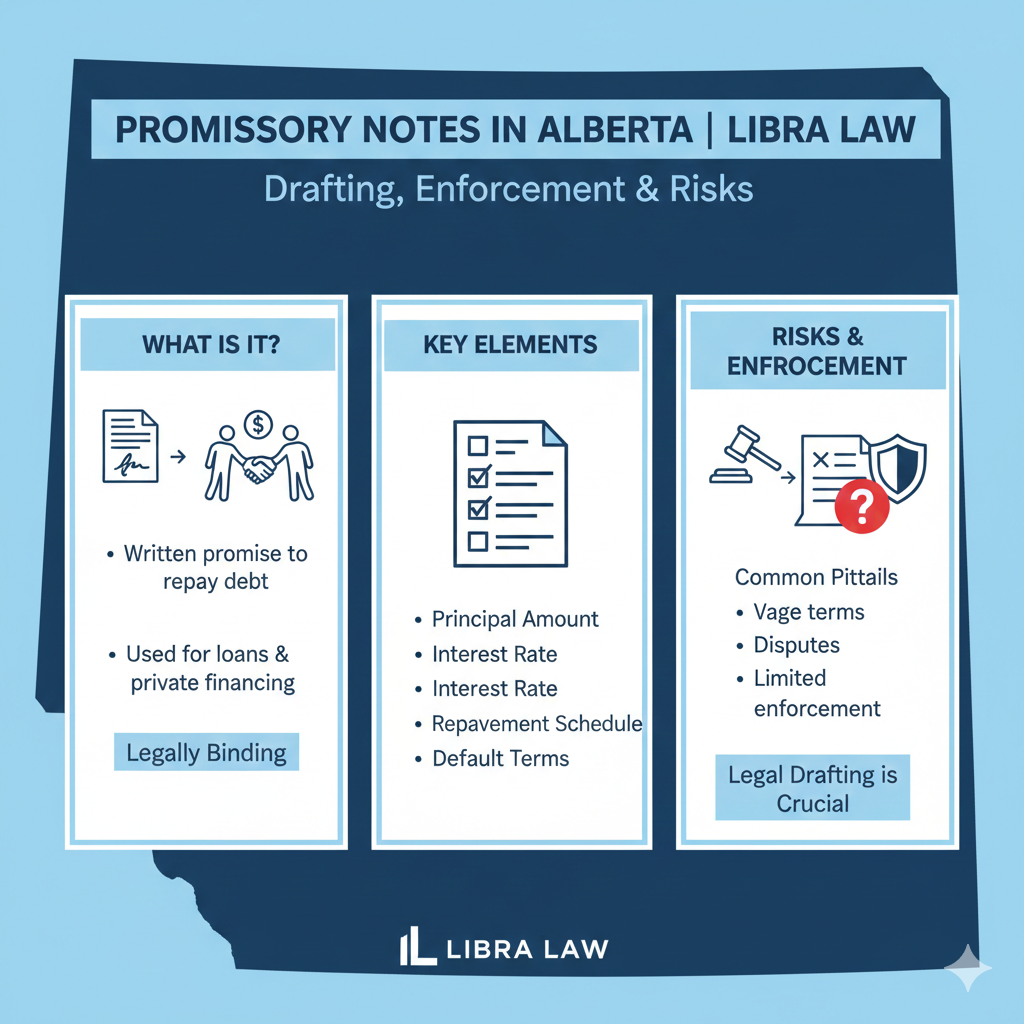

What Is a Promissory Note?

A promissory note is a written promise by one party (the borrower) to repay a specific sum of money to another party (the lender), either on demand or at a set time.

Promissory notes are frequently used in situations such as:

- Loans between business partners or shareholders

- Financing provided to a corporation by its owners

- Private loans between individuals

- Deferred payments in business purchases

Despite their simplicity, promissory notes are legally binding contracts.

Key Elements of a Valid Promissory Note

To reduce the risk of disputes, a promissory note should clearly address:

- The principal amount owed

- Interest rate (if any)

- Repayment terms and schedule

- Whether the note is payable on demand or at a fixed date

- Consequences of default

Vague or incomplete terms can make enforcement more difficult and increase litigation risk.

Demand vs Term Promissory Notes

Promissory notes generally fall into two categories:

Demand Notes

A demand promissory note allows the lender to demand repayment at any time. While flexible, demand notes can create uncertainty for borrowers and raise questions about when repayment is actually required.

Term Notes

A term promissory note sets out a fixed repayment date or schedule. These notes offer greater predictability but require careful drafting to address defaults, interest accrual, and extensions.

Choosing the right structure depends on the relationship between the parties and the purpose of the loan.

Common Pitfalls and Legal Risks

Promissory notes frequently cause problems when they:

- Lack clear repayment terms

- Fail to address the interest properly

- Do not specify default consequences

- Are inconsistent with shareholder or corporate agreements

For businesses, promissory notes should be coordinated with other corporate documents. For example, lenders who are also shareholders should consider how the note interacts with ownership rights. You may find it helpful to review why your business needs a shareholders’ agreement to understand how these documents work together.

Enforcement Issues in Alberta

When a borrower fails to repay, enforcement can be more complex than expected. Issues may arise around:

- Whether the note is truly payable on demand

- Whether interest provisions are enforceable

- Limitation periods for commencing legal action

Clear drafting reduces uncertainty and strengthens enforcement options if repayment becomes an issue.

Promissory Notes in Business Purchases

Promissory notes are sometimes used as part of a business sale, particularly where part of the purchase price is deferred. In these cases, promissory notes should align with the overall transaction structure.

If you are buying or selling a business, it is important to consider how financing arrangements interact with the broader transaction. For background on transaction structuring, you may want to review asset purchase versus share purchase transactions in Alberta.

Why Legal Drafting Matters

Many disputes involving promissory notes arise because parties rely on informal templates or handwritten agreements. Legal drafting helps ensure:

- The note reflects the parties’ true intentions

- Key risks are addressed upfront

- Enforcement options are preserved

A lawyer can also advise whether additional security or guarantees should be considered.

Learn more about how Libra Law supports clients with financing and commercial agreements through its business law services in Alberta. You can also explore related topics in Libra Law’s business law articles.

Get Advice Before You Lend or Borrow

Whether you are lending money, borrowing funds, or structuring private financing, a promissory note should not be treated as a formality. Clear legal advice at the outset can prevent costly disputes later.

The Business Law team at Libra Law provides practical, plain-language guidance to Alberta businesses and individuals using promissory notes. You can contact our firm to discuss drafting or enforcing a promissory note and move forward with confidence.

This article is for general informational purposes only and does not constitute legal advice. To obtain advice specific to your situation, please consult a lawyer or qualified professional.